Expenses

The Expenses section is where we'll forecast all of the costs we expect the business to incur over time.

Expenses

Your expenses are all the costs you incur in operating your business. There are many different types of expenses that vary widely across business type and situation. To assist with clarity and to provide a better understanding of a company's cost structure, accounting rules dictate that costs are segmented into "buckets", the most commonly known of which are:

Cost of Goods Sold (COGS): The total cost incurred in the production and delivery of a product or service

Sales, General, and Administrative (SG&A): The costs you incur as part of normal business operations (also called "Overhead")

An easy way to distinguish between these two seemingly similar buckets is to consider this: if a customer wanted to buy my service, what costs would I absolutely have to incur in order to deliver it. For a SaaS company, they simply could not deliver their product without paying for hosting costs, so that would be categorized as part of COGS. However, while their sales team is productive in bringing new customers, they technically could deliver their product without the sales team if someone came in the door wanting to buy - so we would categorize their expenses as SG&A.

There are other types of expenses beyond purely COGS and SG&A such as debt expenses, which you'll find in Sturppy. We will briefly cover these but focus mostly on COGS and SG&A because they are relevant to all businesses.

Expenses Dashboard

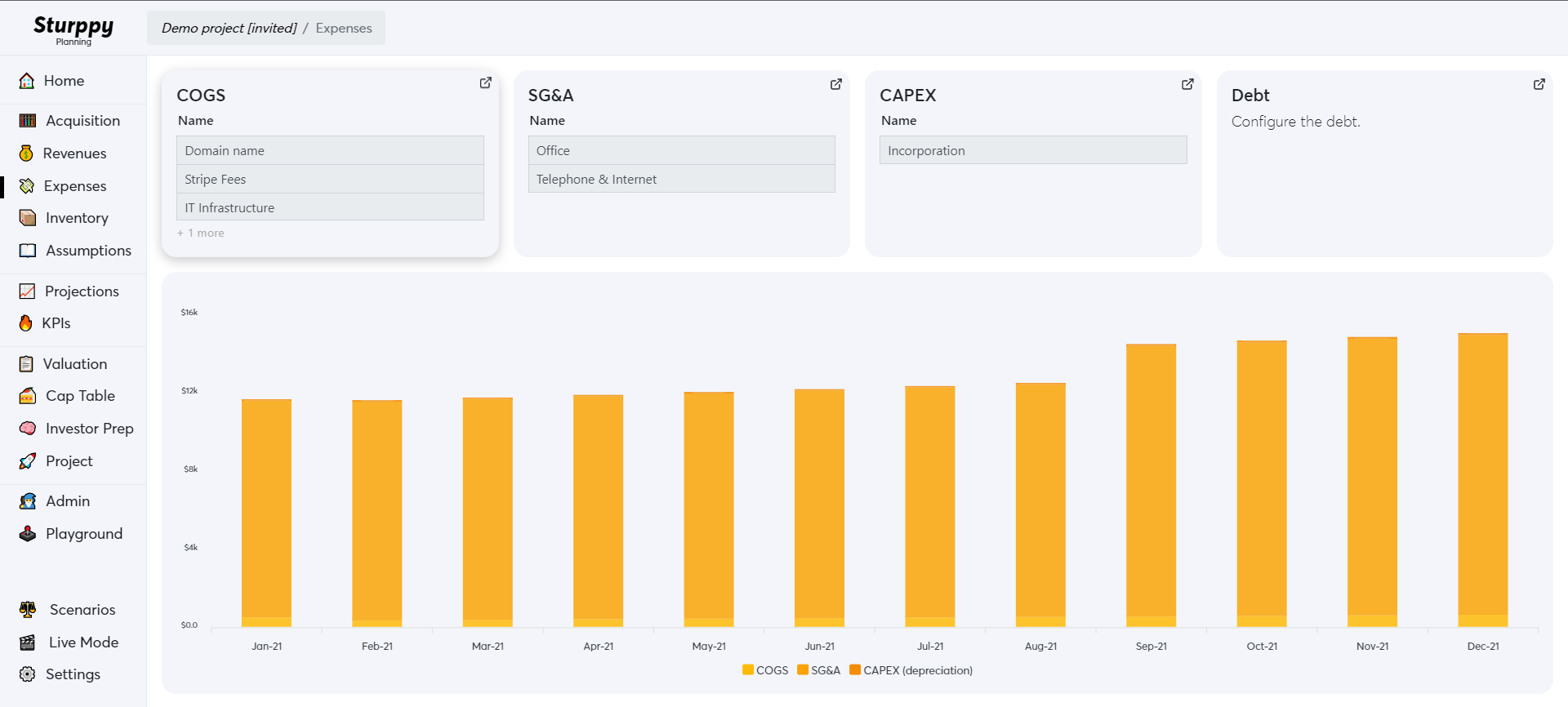

The first area you'll see when you click the "Expenses" section of the Navigation bar is this:

From here you can access all of the main expense buckets of your model and see a graph showing the breakdown of all expenses you have inputted. To add or edit any expense, simply click into its respective bucket.

Adding COGS

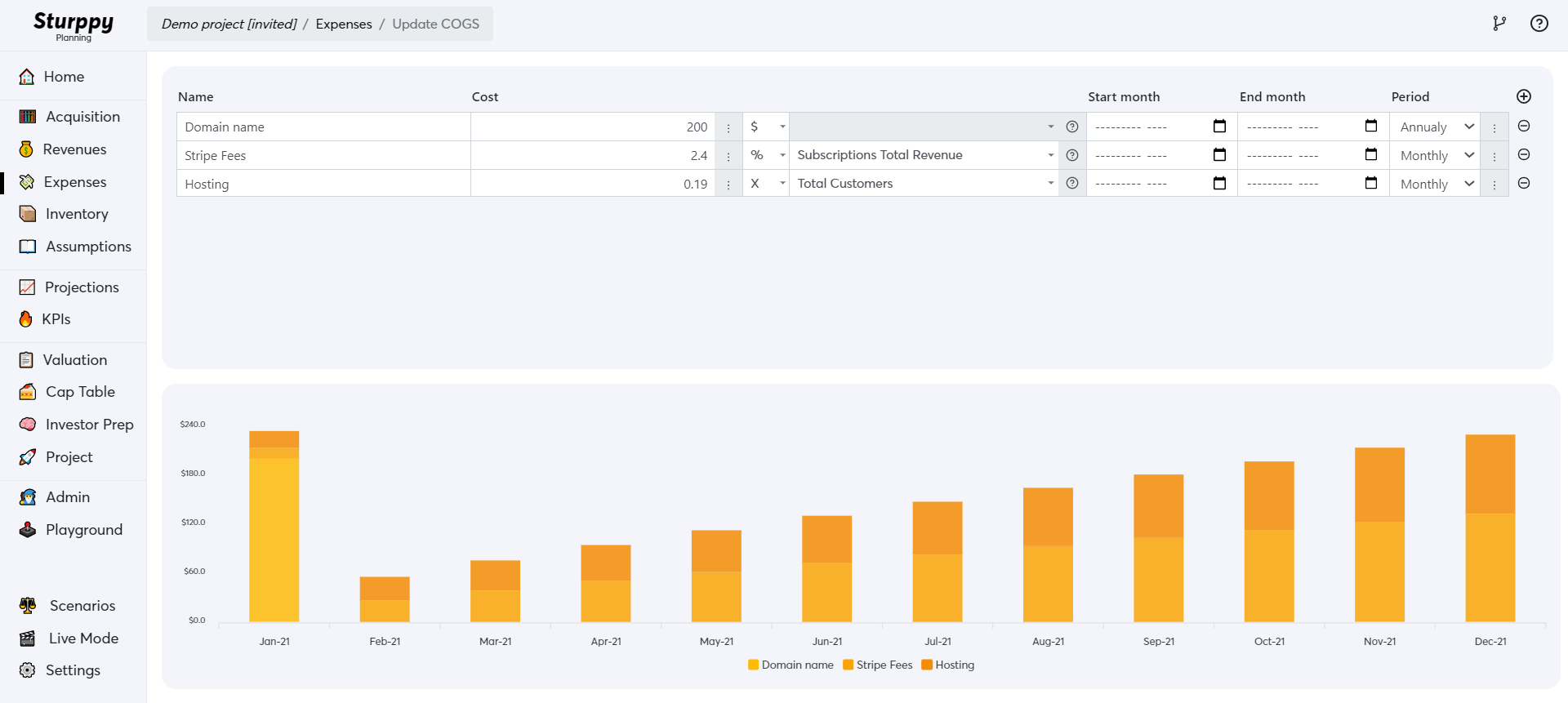

To add COGS, we click into the COGS section of expenses and are presented with the following screen:

Here you'll see a couple of pre-populated COGS expense items that are common in SaaS. You can see that that the first two fields are fairly self explanatory - the name of the expense and the cost of the expense. However, the next couple columns are important to pay attention to.

Many costs, especially COGS, are driven by some other part of the business. For example, if you're SaaS company using Stripe to process payments, every single payment received will have a Stripe transaction fee associated with it. In the image above, you'll see that we've made assumptions about our SaaS model that reflect that all revenue are subject to Stripe transaction fees, taking 2.4% of total revenues.

The two columns to the right of "Cost" are how you can create expenses that are variable based on another line item - be it number of customers, total revenue, and more. You have a modifier - in this case a percentage - and the line item off of which the expense is driven. Further to the right of that, we have the start and end dates of the expense, and "Period" refers to how often the expense is incurred.

Adding SG&A

Adding SG&A expenses is very similar to adding COGS expenses, but you have more "sub-buckets" to choose from:

You'll see that your labor costs in the "Employees" section is separated from the rest of the "General & Administrative" expenses, and "Custom SG&A" expenses which we will address in the Flow Diagram section and skip here. The reason employees are separated from SG&A and why we'll focus on them here is for multiple reasons, but primarily because modeling labor expenses is a bit different than other expenses, and secondarily because employees are the most expensive cost for most businesses.

Adding Employees

Employee costs are like other costs in that when we model them, we often drive hiring off of other parts of the business. For example, the more customers you acquire, the more customer support people you are likely to need.

Where there is a bit more nuance to employee expenses is that you have to account for salary increase and capital expenditures (CAPEX) associated with employees that do not apply to other expenses. Capital expenditures are the assets you purchase to support an employee in doing their job - one example would be a work computer.

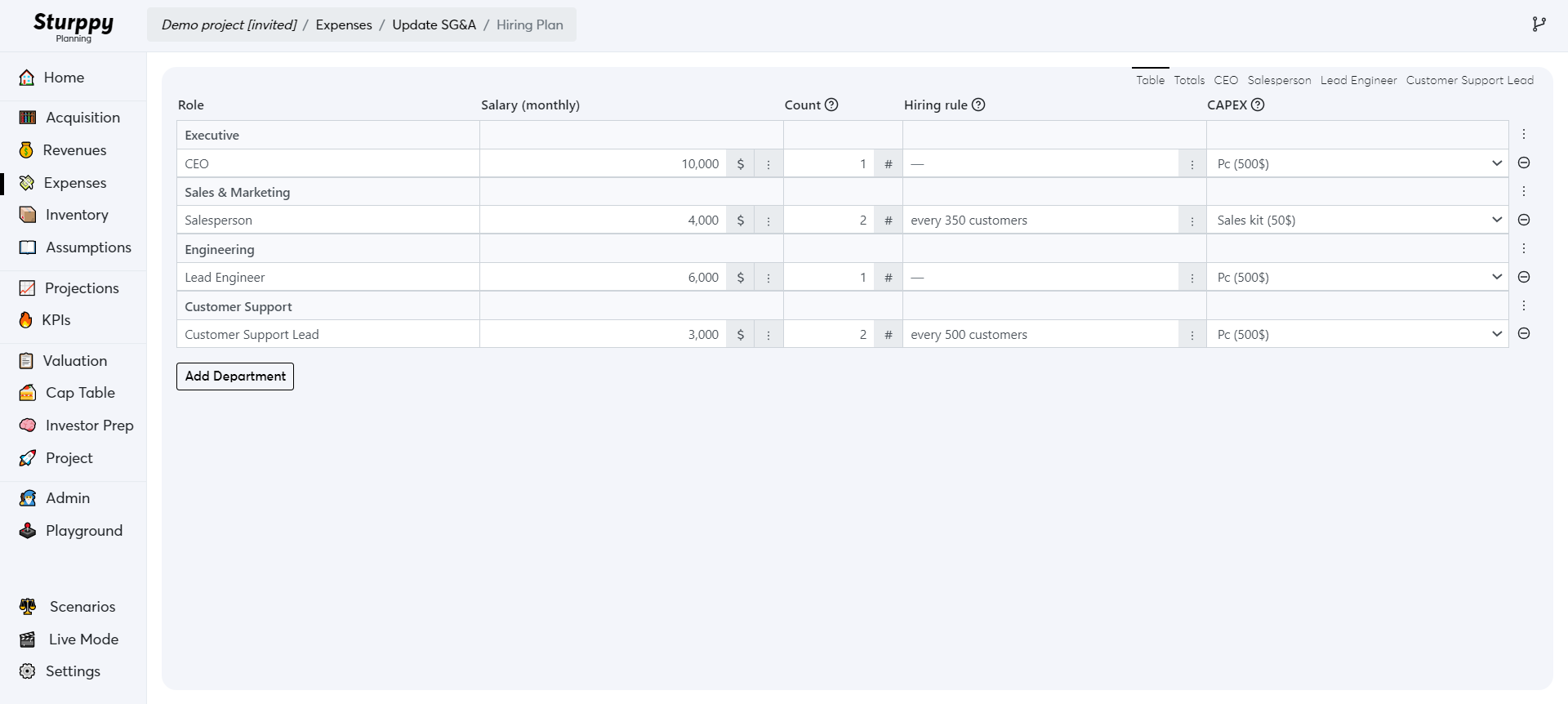

Here's an example of what hiring expenses would look like:

You can see that employees are segmented by department, and you can add departments in the lower left of the screen. To the right, you'll see salaries and the number of people in the role. You can make changes to salary increases, maximum salary over time, and other modifications by clicking the triple ellipse next to the salary.

The hiring rule is where we decide if the number of hires is driven off another part of the model - i.e. a new customer support agent for every 500 customers - or off a static number we select - i.e. there will only be one CEO. Clicking on the triple ellipse next to the hiring rule will allow you to select a driver for the particular hiring rule. If you don't have one, simply leave it blank.

Lastly, we see the CAPEX - in this case a computer the company buys for the employee - that we attribute to each employee. We need to add those in the CAPEX section of the Expenses section so that they show up when we attribute them to each hire.

Adding General & Administrative Expenses

Adding these expenses is basically the exact same process as you would with COGS. To provide a baseline of common SG&A costs that you might want to add, here's a good list to start off:

Sales & Marketing

R&D

Contractors and Consultants

Office Space Rent & Utilities

Business Travel and Entertainment

These should give you a basis for when trying to account for all your overhead costs that should be included in your model.

Last updated